January 2011

Article

AutomatedBuildings.com

[an error occurred while processing this directive] (Click Message to Learn More)

The ultimate goal is to maximize the attainment of energy reduction, while minimizing the effect on occupants and building performance.

But the "real money" is in the demand response business.”

Jim Cramer, host of CNBC's Mad Money, co-founder and chairman of TheStreet.com, Inc

M

arkets

are created in supply and demand of goods and services. For electric

utilities to meet periodic peak demand for their services the choices

are two: make the capital investments in power generation and “supply”

sufficient capacity to meet the peak demand or simply lower peak demand

and undercut the need for the extra capacity investment. Demand

response is the “lower demand” strategy that pays users for reducing

their demand rather than having the utilities invest in peak generation

that may often sit idle. Note that the opposite is true as well – that

lower energy pricing can assist the supplier to sell more power in

times of low demand.

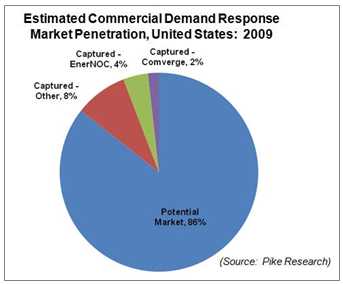

Demand response (DR) is a great strategy from several aspects;

economically, environmentally and socially. It is the most visible of

numerous strategies where the utility grid and a building with its

related assets (such as on-site power generation or storage) are

communicating to optimize the supply, demand, costs and prices. It’s

the option with the most immediate potential and most likely the one

that the Smart Grid will best be known for.

For

building owners demand response is a real opportunity to generate small

or modest revenue. DR payments vary widely based on region, a

building’s load profile, the ability to curtail, etc., however, owners

can expect payments in the range of $20-45K per MW curtailed each year.

For

building owners demand response is a real opportunity to generate small

or modest revenue. DR payments vary widely based on region, a

building’s load profile, the ability to curtail, etc., however, owners

can expect payments in the range of $20-45K per MW curtailed each year.

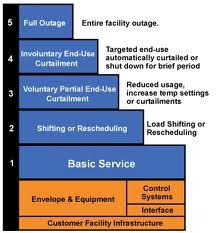

DR also forces building owners to think about how exactly they can reduce energy consumption which is beneficial even when there isn’t a demand response event. However, don’t expect to sit back and just collect checks or credits from your utility. To take advantage of demand response building owners will need to do a number of things:

- develop a detailed energy curtailment plan or more likely an array of reduction plans based on different levels of energy usage

- provide the means to measure and verify the plan results or performance through metering and sound measurement and verification practices

- automate the building’s response to a curtailment event

It is in

the development of the details for the curtailment plans, the M&V

process and the automation of the response that provide the key for

building managers to unlock the potential of DR.

Curtailment Plans

Curtailment plans for building owners are more than just about energy;

they must take into consideration business operations, priorities

within the organization, critical systems and spaces, and occupant

comfort and productivity. The ultimate goal is to maximize the

attainment of energy reduction, while minimizing the effect on

occupants and building performance.

Curtailment plans for building owners are more than just about energy;

they must take into consideration business operations, priorities

within the organization, critical systems and spaces, and occupant

comfort and productivity. The ultimate goal is to maximize the

attainment of energy reduction, while minimizing the effect on

occupants and building performance.

Different building uses require different approaches to curtailment.

For example, a hospital or other healthcare facility may have a

curtailment plan that turns off all non-essential lighting, delays the

use of dishwashing or laundry and reduces the number of usable

elevators and escalators. The curtailment plan in an office building

may involve resetting the temperature for air conditioning, slowing fan

speeds, reducing overhead lighting, turning off all non-critical or

unused equipment and doing so only in non-executive areas. Educational

facilities may curtail the use of cafeteria and kitchen equipment,

reset thermostats or delay the use of laboratories. The point is

that each building owner or manager needs to develop varied detailed

curtailments for different levels of reduction. This is challenging and

requires the input and cooperation of numerous constituencies and

communication with all affected.

Financial Aspects

The contract a building owner will enter into regarding demand response

will have several critical elements. Initially, there is an eligibility

threshold; the building must consume a minimum level of energy and then

typically through an energy audit will also demonstrate that it can

reduce energy and meet minimum curtailment goals.

Assuming the building is eligible the building owner can make money

from a typical demand response contract in two ways: (1) participation

in the program and (2) performance or level of energy reduction – it’s

somewhat analogous to a professional athletic getting paid a base

salary for playing and then bonuses for performance.

Energy performance is determined by comparison based on the building’s

baseline. Since demand response is likely to occur during the summer

months, a baseline is typically the average peak demand of the building

during the most recent summer. An energy audit can provide the target

for energy reduction during events that the building owner will commit

to. They would then commit to a certain kWh reduction for a certain

price per kWh and get paid based on actual performance.

Building owners also can be compensated for their participation in the

program. This strategy is based on a price per kW that takes into

account the building owner’s commitment to the number of DR events over

a predetermined time period. Note that there may be financial penalties

associated with shortfalls to the curtailment commitment. Here’s an

example from MPower of the possible payments:

In the above example, participation payments are $45.00 per pledged kW

with a commitment of 10 curtailment events over 5 years. Payments for

each event are $0.35 per pledged kWh reduced during an event. The

higher payments are for a 5 year commitment with payments slightly

decreased for shorter terms.

[an error occurred while processing this directive]

Building owners or an owner of a portfolio of buildings will deal or

contract with a utility or an aggregator depending on the total energy

consumption and the potential for curtailment. They will enter into a

contract with the utility or aggregator addressing the curtailment

events they want to participate in, the term of the agreement, minimum

amounts of curtailment, how the curtailment will be verified, etc.

Curtailments are likely to be seasonal, restricted to weekdays,

targeted to a time window reflecting peak hours and have limited

duration. Usually energy reductions have to be at least 15% of the

building’s baseline. DR events are usually triggered by high

temperatures or by system emergencies and market-price conditions

within the grid and power industry. Customers are generally given

24-hour notice of an event.

Users are stratified and offered programs based on their size or

under-lying industry. Typically large businesses or high demand

customers are those with monthly demand of at least 200kW, while

Small/Medium size customers have monthly demand below 200kW. Some

building uses such as government, subsidized housing, hospitals,

universities, etc. may not need to meet all eligibility requirements in

order to still participate.

Here are some examples of what specific companies and buildings are receiving from participating in DR:

- The University of Rhode Island enrolled in demand response in 2008. Their curtailment plan involved adjusting cooling, air handling, lighting, and elevator use in its main 300,000-square-foot building allowing URI to reduce its energy consumption by 300 kilowatts (kW). URI earns more than $10,000 annually in DR payments.

- NetApp, an IT company headquartered in Sunnyvale, California that is involved in data storage and data management solutions, significantly reduced energy consumption at its headquarters. They used 54 million kilowatt hours annually with a peak demand of 7.6 megawatts. In 2008, NetApp's annual utility bill was $7.7 million, about 90% of that was for electricity. Their demand response was to reduce lighting by 50% and raise the temperature setpoint by 4 degrees, thus resulting in a shedding of 1.1 MW. PG&E pays NetApp $0.50/kWh when the request is made the day before and $0.60/kWh if the request is made the same day. In 2008, NetApp participated in two demand-response events. Each time, the company shed 1.1 out of 7.6 megawatts. NetApp received $3000 to $5000 per event. The company also was paid a one-time participation payment of $130,628 in 2007.

The market for this type of scenario and the interactions between consumers and suppliers is rapidly evolving. The programs and pricing models available encompass many variations and user requirements including:

- Time-of-use (TOU) reflecting the cost of supply

- Real-time pricing (RTP) reflecting hourly changes in wholesale pricing

- Critical Peak Pricing (CPP) a hybrid of real time and time of use for certain conditions

- Direct Load Control aimed at residential and small businesses where the program operator will shut down a customer’s equipment

- Demand Bidding/Buyback Programs where large customers can bid to curtail power based on wholesale market prices

- Emergency Demand Response Programs where customers reduce loads during periods when reserve shortfalls occur

- Ancillary Services Market Programs where customers can bid load curtailments in Independent Systems Operators and Regional Transmission Operators.

This review of Demand Response takes a general overview and provides an impetus for us to at least make decisions for our homes and possibly for our small businesses. This overall interaction of suppliers and users is fast growing, rapidly evolving and involves many emerging organizations and programs. One could expect the automation of building and grid communication and the automation of the financial and energy marketplace to develop in parallel resulting in the whole process being automated, something analogous to software tools use in other markets and exchanges to optimize supply, demand and pricing.

For more information, write us at info@smart-buildings.com

[an error occurred while processing this directive]

[Home Page] [The Automator] [About] [ Subscribe ] [Contact Us]