PetroSeychelles, a state-backed oil company, said its negotiations with oil minnow Sub Sahara Resources (SSR) should conclude shortly, while the planning process could complete within the next two years.

Seychelles could fast-track permission to hunt for oil in the waters of its archipelago of tropical islands within weeks, paving the way for drilling by the end of the decade.

Chief executive Patrick Joseph said: “If there are no big issues – which I don’t think there will be – we should complete negotiations within one month.”

Mr Joseph said the islands could host a “world-class” oil discovery based on its early test drilling. The region has only undertaken four early test wells, of which three have suggested “excellent” hydrocarbon reserves just a hundred yards below sea level.

It is too soon to say exactly how lucrative the reserves might be, but at shallow water depths it is likely to be a low-cost option for hopeful oil producers, he said.

PetroSeychelles began formal negotiations with SSR less than a fortnight ago in a bid to bring an end to a difficult few years for the group, which has already lost a string of potential partners.

The tropical island basin was a key focus of failed oil company Afren before it crashed out of the London stock exchange after plunging into administration in 2015 .

Ophir Energy and its partner WHL Energy, an Australian firm, both pulled out of the hunt for oil after internal wrangling between the pair caused the deal to collapse. Japan’s state oil and minerals group, known as Jogmec, is also understood to have backed away due to the lower-than-expected oil price.

PetroSeychelles believes that SSR could fast-track its seismic research work by building on the advances made by previous, unsuccessful partnerships. Privately held SSR is based in Australia.

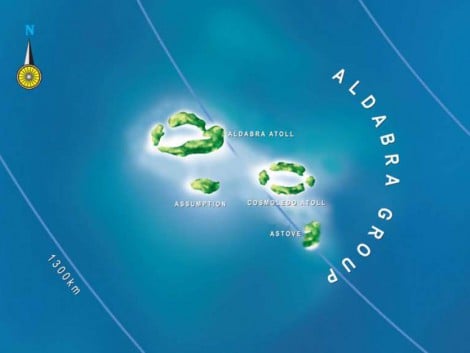

However environmental protection for the islands’ marine biodiversity could still scupper plans for the Commonwealth nation’s first commercial oil production, which campaigners fear could harm its vital tourism industry.

PetroSeychelles is in talks with the government about how it plans to manage its conservation areas, but says it is not completely clear how environmental management plans will evolve in the years ahead, which could pose a major challenge to investors.

“The indication that we have been given so far is that the management plans will be the kinds of plans that we already have in place. But we need to see that written,” Mr Joseph said.