PR

X

カレンダー

キーワードサーチ

▼キーワード検索

コメント新着

カテゴリ: 投資

Update

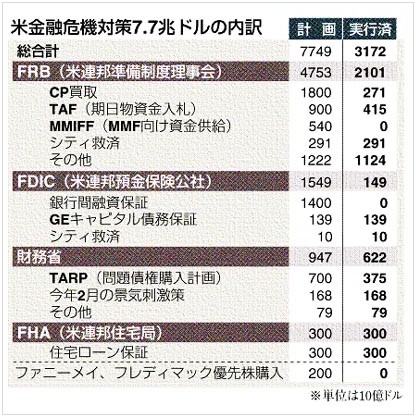

米国のこれまでの救済額を確認しておこう、

Our $7.4 Trillion Bailout

Nov 24, 08 10:14 AM

How is it that anyone can claim with a straight face that the government will likely make money from its various bailout investments? We suspect that anyone saying this is completely out of touch with the size of the losses, bailout funds and emergency lending programs. Because if you add those up, as Bloomberg did today, they amount to more than $7.4 trillion dollars. And it's growing.

Where's all that money coming from?

* $2.4 trillion in commercial paper purchases by the Fed.

* $2 trillion in other loans and pledges from the Fed.

* $1.4 trillion in rescue committments, including higher deposits insurance. Bloomberg explains: "The FDIC, chaired by Sheila Bair, is contributing 20 percent of total rescue commitments. The FDIC’s $1.4 trillion in guarantees will amount to a bank subsidy of as much as $54 billion over three years, or $18 billion a year, because borrowers will pay a lower interest rate than they would on the open market, according to Raghu Sundurum and Viral Acharya of New York University and the London Business School."

* $892 billion for the Treasury's TARP and other Hank Paulson rescues.

* $300 billion from FHA to guarantee mortgages through the Hope for Homeowners program, designed to keep distressed borrowers from foreclosure.

* $444 billion bailout bucks for Sheila Bair's mortgage program. Bloomberg: "Not included in the calculation of pledged funds is an FDIC proposal to prevent foreclosures by guaranteeing modifications on $444 billion in mortgages at an expected cost of $24.4 billion to be paid from the TARP, according to FDIC spokesman David Barr. The Treasury Department hasn’t approved the program."

So with the housing modification plan, that's $7.8 trillion.

Does anyone believe that it is even possible to calculate your expected return on a $7.8 trillion investment? Of course it's not. That is several times the total profits of the entire economy.

Think about it this way: banks have to make all that money just to pay us back. Do you really think that's going to happen?

救済額というと7000億ドルが有名だが、

昨年からの救済の実態額はその10倍以上ある、

主なものは下記のとおり、

2.4兆ドル :CP買取 by FED、(いつの間に?)

2.0兆ドル :他のローン貸出し by FED、(例のバランスシートね、)

1.4兆ドル :預金保護の追加 by FDIC、(2500万とか言ってたね、)

8920億ドル :TARP & Paulson分、(7000+Alphaで、)

3000億ドル :FHAの住宅差し押さえ対策、

4440億ドル :FDICの住宅プログラム、含む住宅差し押さえ対策、

ここまでで 7.4兆ドル 、

その他もろもろで計 7.8兆ドル 、

すごい大盤振る舞いだが、問題は、

これ、どっから調達するのかということ、

そして、この7.4兆ドルはリターンに見合う投資内容か否かということ、

最後に、この金額、ほとんど銀行関係に注がれているのだが、銀行は本当に返す気があるのかということ、(きついね、)

こういう実態と、

毎週増え続けるFRBのバランスシートなどを見ると、

Factors Adding to Reserves and Off Balance Sheet Securities Lending Program

米国の借金踏み倒しで、新通貨発行などといううわさが、

ますます 信憑性を持ち始めてくるわけだ、

追記)

G20での一こま、

This is especially interesting considering the summit consisted of the G20 and was an attempt to find a solution to the current finanacial crisis. Furthermore, the summit was in Washington and Bush was the host.

He got the cold shoulder anyways.

ブッシュはすでに時の人ではなくなっている、

(誰も彼と握手しようとしない、)彼は金融危機打開のG20のホスト役なのにーー、これでは、打開策はやはり、踏み倒ししかなさそうだ、

追記2)

まとめの表を追加、

お気に入りの記事を「いいね!」で応援しよう

[投資] カテゴリの最新記事

-

あなたの伴侶は? 2023年01月11日

-

不動産投資をやめた理由 2014年01月23日 コメント(2)

-

昔の名前で出ています、リンゼーウィリア… 2013年07月03日

【毎日開催】

15記事にいいね!で1ポイント

10秒滞在

いいね!

--

/

--

© Rakuten Group, Inc.