2008年05月の記事

全51件 (51件中 1-50件目)

-

Dive#7, #8 グアム

もぐりましたグアムのブルーホールとガラランバンクてとこ。グアムで潜るんだったらブルーホールて思ってたけど、経験本数20本以上とか、アドバンスのライセンスが必要とかってあったりはぁ?はーとぉ?今そんなきぶんじゃないんだよね、みたいなとこもあったり少なくとも今回のグアムでは私には縁のない場所とあきらめてたのでめちゃうれしーの一緒にもぐったのは、ベテランのおちゃめなおじさま2人と、アドバンスコース受講中の20代の女の子。ガイドさんはパラオ出身のCさん。小さなボートには私たちだけ。ブルーホールはグアムで一番人気のポイントなんだって。が、幸い一番乗りで他のボートいませんでした。ロープにつかまって潜行するとすぐに穴が。水深18mに入口がある縦型の洞窟で、穴から下に入っていきます。中に入って上を見上げると、さっき入ってきた入口がブルーのハートにアドバンスの講習中の子がハートの下で計算問題を解いていた!そのあいだハートにうっとりしつつもデジカメデビューしました。今日の透明度は40m。前日は6mだった?!らしいのでラッキー。抜ける時は36mのとこにある横穴から抜けました。この洞窟、深さ80mとかあったらしい。暗くて下がよく見えなかったからよかったけれど。深いとこで妙に息苦しくなって、その後の記憶はあまりありません。見かけた子たち:マダラトビエイ、バラクーダ。2本目はつかまるロープなしでの潜行でした。耳が痛かった。入る前からトイレ行きたくて、、、、50分間、頭の中はトイレっトイレっ・・・そしてオエーってなるし(汗)でもそれらを割り引いても珊瑚とお魚ちゃんたちはめちゃきれいで見かけた子たち:ウミウシ。クマノミ。バラクーダ。カサゴ。他お魚たくさん。ダイブコンピューターがないので、ガイドさんより浅い位置をキープって思ってたら、2本目はガイドさんがえらく高い位置を泳いではった。長く遊ばせてくれるためのサービス?ランチの後、私以外は3本目「ガンビーチ」だって。ガンビーチはシュノーケルしたからいいや。

May 29, 2008

-

これからだいびんぐ!

今日はだいびんぐなのに。ねむれなかった。ユンケルでだましだましはたらかせてたからだからかしたものちゃんとかえしてもらわないとねと言われてるみたいになんだかからだがいたい(笑あともちょっとだけまってください。でも今日も空がめちゃ綺麗気分は海でだれに会えるんでしょいつかシーちゃんに会った時に記念撮影ができるように今日はカメラを持ち込んで試し撮りをしたいけどそんな余裕きっとないんだろな。

May 29, 2008

-

これからてすと!

朝ごはん食べて、温泉にもつかってリラックスしたのでこのまま寝たいところですが。これからテスト受けにいってきいます。今日は体調がよい

May 28, 2008

-

ROA = Profit Margin X Assets Turnover Ratio

ROA = Profit Margin X Assets Turnover Ratio Profit Margin = Net Income / Sales Assets Turnover Ratio = Sales / Averages Total Assets Net Income = ------------------------ Average Total Assets

May 28, 2008

-

Capital Market Analysis Ratios

Price Earnings (PE) Ratio Market Price of Common Stock Per Share = --------------------------------------------- Earnings Per Share Market to Book Ratio Market Price of Common Stock Per Share = ------------------------------------------------------- Book Value of Equity Per Common Share Book Value of Equity Per Common Share = Book Value of Equity for Common Stock / Number of Common Shares Dividend Yield Annual Dividends Per Common Share = ------------------------------------------------ Market Price of Common Stock Per Share Book Value of Equity Per Common Share = Book Value of Equity for Common Stock / Number of Common Shares Dividend Payout Ratio Cash Dividends = -------------------- Net Income

May 28, 2008

-

Capital Structure Analysis Ratios

Debt to Equity Ratio Total Liabilities Debt to Equity Ratio = ---------------------------------- Total Stockholders' Equity Interest Coverage Ratio Income Before Interest and Income Tax Expenses Interest Coverage Ratio = -------------------------------------------- Interest Expense Income Before Interest and Income Tax Expenses = Income Before Income Taxes + Interest Expense

May 28, 2008

-

Activity Analysis Ratios

Assets Turnover Ratio Sales Assets Turnover Ratio = ---------------------------- Average Total Assets Average Total Assets = (Beginning Total Assets + Ending Total Assets) / 2 Accounts Receivable Turnover Ratio Sales Accounts Receivable Turnover Ratio = ----------------------------------- Average Accounts Receivable Average Accounts Receivable = (Beginning Accounts Receivable + Ending Accounts Receivable) / 2 Inventory Turnover Ratio Cost of Goods Sold Inventory Turnover Ratio = --------------------------- Average Inventories Average Inventories = (Beginning Inventories + Ending Inventories) / 2

May 28, 2008

-

Profitability Analysis Ratios

Return on Assets (ROA) Net Income Return on Assets (ROA) = ---------------------------------- Average Total Assets Average Total Assets = (Beginning Total Assets + Ending Total Assets) / 2 Return on Equity (ROE) Net Income Return on Equity (ROE) = -------------------------------------------- Average Stockholders' Equity Average Stockholders' Equity = (Beginning Stockholders' Equity + Ending Stockholders' Equity) / 2 Return on Common Equity (ROCE) Net Income Return on Common Equity (ROCE) = -------------------------------------------- Average Common Stockholders' Equity Average Common Stockholders' Equity = (Beginning Common Stockholders' Equity + Ending Common Stockholders' Equity) / 2 Profit Margin Net Income Profit Margin = ----------------- Sales Earnings Per Share (EPS) Net Income Earnings Per Share (EPS) = --------------------------------------------- Number of Common Shares Outstanding

May 28, 2008

-

Liquidity Analysis Ratios

Current Ratio Current Assets Current Ratio = ------------------------ Current Liabilities Quick Ratio Quick Assets Quick Ratio = ---------------------- Current Liabilities Quick Assets = Current Assets - Inventories Net Working Capital Ratio Net Working Capital Net Working Capital Ratio = -------------------------- Total Assets Net Working Capital = Current Assets - Current Liabilities

May 28, 2008

-

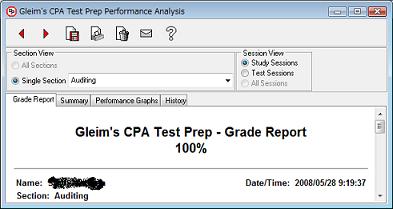

Done

To Do List for preparing AUDIT testing on 5/28- Ck updates on the Becker’s site; done on 5/26- Read and sum - Standards and planning; done on 5/27- Read and sum - Internal Control; done on 5/26- Read and sum - Substantive Test; done on 5/27- Read and sum - Reporting; done on 5/26- Gleim CD - Planning (MC388)- Gleim CD - Internal Control (MC249)- Gleim CD - Substantive Test (MC511)- Gleim CD - Reporting (MC519)- Wiley - Planning; done on 5/27 8:30am(121/129, 93%)- Wiley - Internal Control; done on 5/27 15:20(149/162, 91%)- Wiley - Substantive Test;- Wiley - Reporting; done on 5/27 18:30(170/181, 93%)- AICPA release question 2007 (MC50); done on 5/27 19:50(47/50, 94%)- AICPA release question 2006 (MC50); done on 5/27 20:30(49/50, 98%)- AICPA release question 2005 (MC50); done on 5/27 21:30(48/50, 96%)- USEN simulation 1 ;done on 5/28- USEN simulation 2 ;done on 5/28- USEN simulation 3 ;done on 5/28- USEN simulation 4 ;done on 5/28 - USEN simulation 5 ;done on 5/28 - USEN simulation 6 ;done on 5/28 - USEN simulation 7 ;done on 5/28 - USEN simulation 8 ;done on 5/28 - USEN simulation 9 ;done on 5/28 - USEN simulation 10 ;done on 5/28 あ・don't forget to cry otherwise you wouldn't get cpa :)

May 28, 2008

-

Essey 10 SOA

Smith & Smith, CPAs audit the financial statement of Hansen Co, a public held company, for the year ended September 30, 2005. Assume you are a senior auditor of Smith & Smith. In a memorandum from you to the junior accountant, explain briefly about the authority and responsibility of audit committee under the Sarbanes-Oxley Act of 2002.MemorandumTo: Junior Accountant Subject: Authority and responsibility of audit committee under the Sarbanes-Oxley Act ofUnder the Sarbanes-Oxley Act of 2002, the audit committee must have authority over and be directly responsible for the appointment, compensation, and oversight of the work of auditors for the purpose of preparing an audit report or related work.The Act requires of every company that the audit committee approve all audit services and all permitted non-audit services to be provided by auditors before the services are provided.The Act also requires auditors to report the following matters on a timely basis to the audit committee of the companies;- All critical accounting policies and practices to be used.- All alternative treatments of financial information within GAAP, that have been discussed within management of the company.- Material written communication between auditors and management of the company, such as schedule of unadjusted differences.

May 28, 2008

-

Essey 9 PPS

Auditor may use probability-proportional-to-size-sampling, and classical variable sampling in substantive tests. Edward, assistant auditor, is not certain about the two statistical approaches. Describe in a brief communication to the assistant auditor the advantages of using PPS sampling over classical variable sampling. Memorandum for: Edwards, assistant auditorDate: From: Smith, CPASubject: Advantages of using PPS sampling over classical variable samplingOne of the advantages of PPS sampling over classical variables sampling you should understand is PPS sampling is generally easier to use than classical variables sampling. Moreover, the size of a PPS sample is not based on the estimated variation of audited amounts.Since it selects the largest items for testing, PPS sampling automatically results in a stratified sample, and individually significant items are automatically identified.Another advantage is that, if no misstatements are expected, PPS sampling will usually result in a smaller sample size than classical variables sampling. In addition, a PPS sample can be easily designed and sample selection can begin before the complete population is available.

May 28, 2008

-

Essey 8 Audit Risk

Audit risk at the financial statement level is influenced by the risk of material misstatements, which may be indicated by a combination of factors related to management, the industry, and the entity.Describe to a staff auditor in a brief communication about the circumstances that would likely increase audit risk.Memorandum for: Staff auditorDate: January 30, 2004From: Smith & Smith, CPAsSubject: Circumstances that would likely increase audit riskAs an auditor, you should be careful about the circumstances, such as, Client's board of directors is controlled by the majority stockholder, who also acts as the chief executive officer. You should also be considering the audit risk if you find the situation that Client's accounting department has experienced a high rate of turnover of key personnel.In addition to the risk factors related to your client's company itself, there are risk factors related to recent development. For example, if Client changes its method of preparing its financial statements from cash basis to generally accepted accounting principles, or an initial public offering of Client's stock is planned in the near future, you should consider about the conditions. If you find the related party transactions, and they are not disclosed in Client's notes to its current financial statements, you should be concerned about the conditions.

May 28, 2008

-

Essey 7 Confirmation

Two months after sending confirmation request to Dean Corporation, Adler did not receive any responses from Bridgestone Company and sent second request. Describe in a brief communication from Johnson to Adler the alternative substantive procedures that Adler should consider applying to the accounts receivable selected for confirmation for which no responses were received to second requests.Memorandum for: Adler, staff assistantDate: January 5, 2004From: Johnson, CPASubject: Alternative proceduresWhen replies to positive confirmation requests have not been received, you, as an auditor, should apply alternative substantive procedures to the nonresponding accounts receivable. You most likely would examine subsequent cash receipts for the accounts that have been paid. This would include matching such receipts with the actual items being paid. In addition, especially for receivables that have not been paid, you should inspect shipping documents or other client documentation (e.g., sales invoices, customers' purchase orders, etc.) that may provide evidence for the existence assertion.You should also consider reading any correspondence in your client’s file that may indicate disagreements with its customers about the amounts billed or the terms of sales. In addition, you may consider contacting a reputable credit agency to verify the existence of customers who are new to the client or with whom you may be unfamiliar.

May 28, 2008

-

Essey 6 Internal Contorl - Payroll

CCG uses an in-house payroll department at its corporate headquarters to compute payroll data, and to prepare and distribute payroll checks to its employees. Prepare a "Payroll" segment of Adams’s internal control questionnaire that would assist in obtaining an understanding of CCG's internal control and in assessing control risk, in the space below.Do not prepare questions relating to cash payrolls, computer applications, payments based on hourly rates, piecework, commissions, employee benefits (pensions, health care, vacations, etc.), or payroll tax accruals other than withholdings. CHURCHHILL CORPORATE GROUP Payroll Internal Control QuestionnaireQuestion Yes No1 .Are payroll changes (hires, separations, salary changes, overtime,bonuses, promotions, etc.) properly authorized and approved?2 .Are discretionary payroll deductions and withholdings authorized in writing by employees?3 .Are the employees who perform each of the following payroll functions independent of the other five functions? ・Personnel and approval of payroll changes ・Preparation of payroll data ・Approval of payroll ・Signing of paychecks ・Distribution of paychecks ・Reconciliation of payroll account4 .Are changes in standard data on which payroll is based (hires, separations, salary changes, promotions, deduction and withholding changes, etc.) promptly input to the system to process the payroll?5 .Is gross pay determined by using authorized salary rates and time and attendance records?6 .Is there a suitable chart of accounts and/or established guidelines for determining salary account distribution and for recording payroll withholding liabilities?7 .Are clerical operations in payroll preparation verified?8 .Is payroll preparation and recording reviewed by supervisors or internal audit personnel?9 .Are payrolls approved by a responsible official before payroll checks are distributed?10.Are payrolls disbursed through an imprest account?11.Is the payroll bank account reconciled monthly to the general ledger?12.Are payroll bank reconciliations properly approved and differences promptly followed up?13.Is the custody and follow-up of unclaimed salary checks assigned to a responsible official?14.Are differences reported by employees followed up on a timely basis by persons not involved in payroll preparation?15.Are there procedures (e.g. tickler files) to assure proper and timely payment of withholdings to appropriate bodies and to file required information returns?16.Are employee compensation records reconciled to control accounts?17.Is access to personnel and payroll records, checks, forms, signature plates, etc. limited?

May 28, 2008

-

Essey 5 New Board and audit risk

Your firm has been doing the audit of Enright Corporation for several years. Since last year, Enright changed the board of directors from family members owning stock in the company to independent executives with financial experience. In a memorandum to your audit team, explain the impact of the new board on audit risk.To: Audit TeamSubject: New Board and Audit RiskSince last year, our client Enright changed the board of directors from family members owning stock in the company to independent executives with financial experience. The impact of the change is that the independent board of directors should reduce the likelihood that the financial statements are materially misstated. The reasons are the following.First, the independent board of directors are more objective than family members because they lack conflict of interest. Second, they are likely to be more competent than family members because they have prior experiences working with financial data of other companies and have dealt with difficulties in various situations. Third, they provide us a safety valve, which means they can serve as an intermediary between the auditors and management. We can communicate with the audit committee rather than directly with the owners.Overall, the change to the independent board of directors from family members will have good impact on audit risk as well as the relationship with us.

May 28, 2008

-

Essey 4 Work of Internal Auditors

In a brief memorandum to your audit team, describe the considerations of the work of internal auditors in an audit of financial statements. To: Audit TeamSubject: Considerations of the work of internal auditorsOne of the important functions of the internal auditors in a company is to monitor all aspects a company’s internal control. This memorandum describes briefly an independent auditor’s considerations of the internal audit function in auditing the financial statements.The internal audit function of the Client may affect the nature, timing, and extent of the audit. Therefore, the auditor will understand the internal audit functions of the Client, and assess the competence and objectivity of the internal auditors. In attempting to determine the competency, the auditor will look at the person’s education, experiences, and some work produced by the internal auditor. In attempting to determine the objectivity, the auditor will identify the party to whom the internal auditor reports. The internal auditor should report to the audit committee.The audit procedures that internal auditor may affect include the procedures in obtaining the understanding of internal control, risk assessment, and substantive procedures the auditor performs. Even though the internal audit function can be utilized, or coordination of the audit work with internal auditors is efficient, reporting on the financial statements is solely the responsibility of the auditor. This responsibility cannot be shared with internal auditors.

May 28, 2008

-

Essey 3 Lep. Letter

The auditor is required to obtain written representations from management in meeting the third standard of fieldwork. In many audits, the auditor will draft the representations and management will acknowledge the contents. In a brief memorandum to a CPA associate, describe the reasons why auditors draft a management representation letter.To: CPA associateSubject: Management representation letter Although management representations are not substitute for corroborating evidence obtained by applying other substantive procedures, management representations, in some cases, are the only available evidence about important matters of management intent. For example, when a client (management) plans to discontinue a line of business, the auditor may not be able to corroborate this event through other auditing procedures. Accordingly, the auditor should request management to indicate its intent in the rep letter. Actually, the auditor drafts the content and management acknowledges it.Also, one of the major purposes of the management representation letter is to impress upon the management its primary responsibility for the financial statements. These representations may establish an auditor’s defense if a question of management integrity arises later. If the management does not respond fully and completely to auditor inquiries, the rep letter may serve as important evidence in support of the auditor. Therefore, the auditor will draft the rep letter, and management must acknowledge the content.It is important that management must acknowledge responsibility for those important representations by discussing the items with the auditor and by signing the letter.

May 28, 2008

-

Essey 2 Test of control

Since Mr. Larrimer assumed the position of CFO, he has been too busy to take care of delivered goods. Therefore, vendor’s invoices as well as receiving reports have been piled up in a cardboard box for certain periods.In a brief memorandum from Ted to staff members of Barnes and Goosen, LLP, describe the test of controls regarding the situation above, in auditing Simply Steam, Co.,. To: Staff membersSubject: Test of controls regarding the client situationThis memorandum describes the test of controls when an auditor is aware that the client fails to take care of the delivered goods.Management is responsible for establishing controls over the purchases-payables-cash disbursement cycle, and the specific control objectives will be achieved:・Requisitions, purchase orders, and receiving reports are matched with vendor invoices as to quantity and price.・Accounts payable department recomputes the mathematical accuracy of each invoice.・The voucher register is independently reconciled to the control accounts monthly.・All supporting documentation is required for payment and is made available to the treasurer.・The purchasing, receiving, and accounts payable functions are segregated.

May 28, 2008

-

Essey 1 PCAOB

Allan has trained staff auditors of the Allan, Willard & Co in preparation for the Sarbanes-Oxley Act of 2002. In a memorandum to audit team, explain briefly the overview of the Act and the establishment of the PCAOB.To: Junior AccountantFrom: AllanSubject: The Sarbanes-Oxley Act of 2002The Sarbanes-Oxley Act generally applies to U.S. and non-U.S. public companies that have registered securities with Securities Exchange Commission under the Securities Exchange Act of 1934The Act made significant changes to corporate governance, such as the responsibilities of directors and officers, expanded the requirements for auditor independence, and established the organization that oversees accounting firms that audit public companies.Section 101 of the Act establishes the Public Company Accounting Oversight Board to oversee and investigate the audits and auditors of public companies, and sanction both firms and individuals for violations.The Board is composed of five members, including two CPAs, and will be funded by public companies through mandatory fees. Accounting firms that audit public companies must register with the Board and pay annual fees. The Board is authorized to establish auditing and related attestation, quality control, ethics and independence standards to be used by registered accounting firms.Accordingly, accounting firms registered with the PCAOB are required to adhere to all PCAOB standards. The Board is empowered to regularly inspect registered accounting firm's operations and will investigate potential violations of securities laws, standards, competency and conduct.

May 28, 2008

-

Ratios

Current ratioCurrent Assets/ Current LiabilitiesReturn on total assetsNet income / Total assetsTimes interest earned(Interest coverage ratio)(Net income + Interest expense + Income tax expense) / Interest expenseInventory turnoverReturn on equity

May 28, 2008

-

Sampling 2

Advantage of Classical Variable Sampling:- May results in a smaller sample size if there are many differences b/w audited and BVs.- Easier to expand sample size if that becomes necessary- Selection of zero balances does not require special samle design considerations- Inclusion of negative balances does not require special sample design considerationsMean-per-unit projection:Population size:2000Sample size:100Audit value of sample: $25,000Standard deviation: $100Standard error of the mean*: $10Step1: Audit value $25,000/ Sample size100= Mean-per-unit$250Step2: Mean-per-unit $250 * Units 2000 = Point estimate = $500,000 Point Estimates:A.Ration estimation Audited sample $8,000/BV of sample$10,000=80% BV of population * 80% = Point estimate $80,000B.Defference Estimateion: BV of sample $10000 - Audited sample $8000 = $2000/100item =$20(negative)Population 1000item * ($20) = ($20000)BV of population: $100000 - $20000 = Point estimate $80,000Discoverty sampling:Atrribute sampling(Internal Control)expected deviation rate very low

May 28, 2008

-

Sampling 1

Stop-or-go:no fixed siample sizediscovery sampling:when the expected deviation rate is zero or near zeroPPS sampling:sample size = BV of population * Reliability factor / Tolerable error - (expected error * epansion factor)sampling interval = BV of population / Sampling sizeupper limit on misstatements = projected misstatement + allowance for sampling risk (basic precision, incremetal allowance for projected misstatements)Advangage or PPS:- Generally easier to use- Size of sample not ased on variation of audited amounts- Automatically results in a stragified sample- Individually significant items are automatically identified- Usually results in a smaller size if no misstatments are expected- Can be easily designed and sample selection can begin before the complete popuration avairable

May 28, 2008

-

Government Auditing Standards

Types of Audit;Financial AuditCompliance AuditOperational AuditGovernment Auditing StandardsGeneral accounting officeTypes of Government Audits- financial audits financial statements, compliance with laws and regulations, and tests internal controls.- performance audits economy, efficiency, and program audits.--------------------------------------------------------------Yellow book requirement- 10 GAAS(TIP SIE ACDE) + GAGAS- report test of compliance with applicable laws and regulationsReportIntro sameScope; accordance with GAAS and GAGASExplanatory; 1.Compliance is the responsibility of management 2.The auditor performed tests of compliance with the provisions of laws and reg. 3.The auditor's objective was not to express an opinion on overall complianceOpinon; positive assurance on items tested for compliamce negative assurance on items not tested noncompliance or illegal acts must be reported.Explanatory; identifies the recipients of the report: auditee, funding organization, and oversight authority- report on internal contorl and assessment of control risk--------------------------------------------------------------Single Audit Act$300,000 or more assistanceYellow book + Report on Compliance with laws and reg for each program

May 27, 2008

-

Quality Contorl

Quality Control Standards CommitteeDocumentationAll CPA firms are required to:have written policiesfirm's compliance with its quality control policies and proceduresSysteme design and maintenanceCommunication policiesMonitoringassigning responsibiity for quality controlevaluating its policies and procedures-----------------------------------SEC practice section- peer review- CPE(120H every 3 years)- partner rotation(5 years)- reporting on disagreement to the audit committee.- reporting of management advisory services performed to the audit committee.-----------------------------------Elements of QCA assigning personnel to engagementsI independence, integrity, and objectivityC consultation and monitoringP personnel manegementA acceptance of clients

May 27, 2008

-

受験前日のディナーは

これが一番

May 27, 2008

-

Subsequent events

Type 1:conditions existing on or before balance sheet date --> adjust financial statement amountType 2:conditions arising after balance sheet date--> consider for note disclosure

May 27, 2008

-

Documentation

Auditor must complete documentation not later than 45 days after audit report release date.Audit documentation must be retained for a minimu of 7 years from the report release date or longer if required by law.Representation Letter- a letter dated no earlier than the date of the auditor's report.- signed by CEO and CFO

May 27, 2008

-

Property, plant, equipment

Presentation and Disclosure- review disclosures for complience with GAAP- inquire about lien and restrictions- review loan agreements for liens and restrictionsExistance or Occurrenc- inspect additions- vouch additions- review any leases for proper accounting- perform searcj fpr imrecprded retirmentsRights and Obligations- review minutes for approval or additionsCompleteness- perform analytical procedures- vouch major entries to repairs and maintenance expensesValuation- foot summary schedules- reconcile summary schedules to general ledger- recaluculate depreciation

May 27, 2008

-

Inventory

AssertionsPresentation and Disclosure- review disclosures for compliance with GAAP- inquire about pledging- review purchase commitments Existence or Occurance- confirmation of consigned inventory and inventory in warehouses- obseve inventory countRights and Obligations- review cutoffsCompleteness- perform test counts and compare with client's counts- inquire about consigned inventory- perform analytical procedures- account for all inventory tags and count sheetsValuation- foot and extend summary schedules- reconcile summary schedules to general ledger- test inventory costing method- determine that inventory quality- test inventory obsolescence

May 27, 2008

-

Substantive Test

Corroborating evidence - AICPASA Authoritative documentsI InterrelationshipsC CaluculationsP Physial existanceA Authoritative statementsS Subsequent eventsAudit Procedures:Inspection, Observation, Inquiry, Confirmation, Reperformance, Physical Examination, Analytical procedures, Vouch, Traceother terms in written audit programs;agree, analyze, compare, count, examine, foot, read, reconcile, review, scanFinancial StatementAssertionsAudit ObjectivesAudit ProceduresAudit Program

May 27, 2008

-

Missing in Wiley Questions

Wiliey Internal Control149/162(91%)- Provision of the Foreign Currupt Practices Act Every publicly held company must devise, document and maintain IC sufficient to provide reasonable assurances that IC objectives are met.- The relevane of various types of controls to a financial audit Controls over the reliability of financial reporting are ordinarily most directly relevant to an audit, but other controls may also be relevant.- For purposes of an audit of internal contorl performed under PCAOB requirements, and account is significant if there is more than a remote likelihood that it could contain material misstatement.- Significant deficiency relateing to a client's antifraud program Audit committee passivity when conducting oversight functions.- Lead to an adverse opinion material weakness -- Yes, significant deficiencies -- No.- Significant deficiencies The auditor should separately communicate those significant deficiencies considered to be material weakness.

May 27, 2008

-

To do listing...

To Do List for preparing AUDIT testing on 5/28- Ck updates on the Becker’s site; done on 5/26- Read and sum - Standards and planning; done on 5/27- Read and sum - Internal Control; done on 5/26- Read and sum - Substantive Test; done on 5/27- Read and sum - Reporting; done on 5/26- Gleim CD - Planning (MC388)- Gleim CD - Internal Control (MC249)- Gleim CD - Substantive Test (MC511)- Gleim CD - Reporting (MC519)- Wiley - Planning; done on 5/27 8:30am(121/129, 93%)- Wiley - Internal Control; done on 5/27 15:20(149/162, 91%)- Wiley - Substantive Test;- Wiley - Reporting; done on 5/27 18:30(170/181, 93%)- AICPA release question 2007 (MC50); done on 5/27 19:50(47/50, 94%)- AICPA release question 2006 (MC50); done on 5/27 20:30(49/50, 98%)- AICPA release question 2005 (MC50); done on 5/27 21:30(48/50, 96%)- USEN simulation 1 - USEN simulation 2- USEN simulation 3 - USEN simulation 4 - USEN simulation 5 - USEN simulation 6 - USEN simulation 7 - USEN simulation 8 - USEN simulation 9 - USEN simulation 10 あ・don't forget to cry otherwise you wouldn't get cpa :)

May 27, 2008

-

Computer-assisted audit techniques (CAAT)

Computer-assisted audit techniques (CAAT)Test data approach The approach to testing is relatively simple, quick and inexpensive.The client’s program is tested only at a specific point in time rather than throughout the period.Parallel simulationThe size of the sample can be greatly expanded at relatively little add cost.It takes time to build an exact duplicate of the client’s system.CAAT in generalIt’s useful when there are significant gaps in the visible audit trail.The special knowledge and skill are required.Centralized processingDecentralized processingDistributed processingaccess controlEDIWorld wide, Strict standards, Computer disruptionsPreventive control rather than detection controlAuthenticationEncryptionAuditing around the computer: input, outputAuditing through the computer: Computer Assisted Audit TechniquesProgram testingTest data: auditor’s data + client’s program, batch processingIntegrated test facility: live system + dummy dataParallel simulation: client’s data + auditor’s programControlled reprocessing: client’s data + client’s programEmbedded audit moduleContinuous monitoring

May 27, 2008

-

A “top-down, risk-based approach” is required.

Top-down approachThe auditor evaluates risks at the financial statement level, considers control at the entity level, and focuses on accounts, disclosures, and assertions for which there is a reasonable possibility of material misstatement.Risk-based approachIn determining what amount of audit attention should be applied to a particular area of internal control, the auditor assesses the risk that a material weakness in that area may exist, as well as the risk that such weakness will lead to a misstatement in the financial statements.

May 27, 2008

-

Those charged with governance

= audit committee or that have otherwise formally designated oversight of the fianacial reporting process to a group equivalent to and audit committee.not management, ownerunless they are also charged with a governance role.those charged with governance as persons with responsibility for overseeing the strategic direction of the entity and obligations related to the accountability of the entity.two-way communication, must- responsibility, scope and timing of the audit- obtain from them information relevant to the audit; and- provide them with timely ovsevations arising from the audit that are relevant to their responsibilities in overseeing the financial reporting process.

May 27, 2008

-

Attestation Sarndards

Tax serviceはダメよThe accountant expresses a written conclusion about the reliability of a written assertion that is the responsibility of another party.General StandardsT TrainingI IndependenceP PerformanceStandards of Field WorkS SupervisionE EvidenceStandards of ReportingA Assertion must be identifiedC ConclusionR ReservationsD Distribution (general or restricted)

May 27, 2008

-

Agreed-upon procedures

Report on written assertion relating to Specified elements, accounts, or itemsIndependent in titleIdentify users and restrict useState agreed-upon proceduresRefer to AICPA standardsList procedures performed and related findingsList reservations or concerns about procedures/findingsDescribe agreed-upon materiality limitsState ~ audit not done, disclaim opinionNot negative assurance

May 27, 2008

-

Prospective Information

A.Forecasts To the best of management’s knowledge, the future financial position. General useB.Projections Given one or more hypothetical assumptions, the expected future financial position. Restricted useC.Engagement Types Examination Compilation Agree-upon procedures (Reviewはダメ)D.Accountant’s report No negative assurance State that the results of the forecast or projection may not be achieved State that the accountant has no updating responsibilities

May 27, 2008

-

Special Report

A. Other comprehensive basis of accounting report 1. Cash basis 2. Income tax basis 3. Government/Regulatory 4. Price level Before opinion “As described in Note X…which is a comprehensive basis of accounting other than GAAP”B. Specified elements, Accounts, or ItemsC. Compliance with contract or regulatory provisions Must restrict useD. Incomplete Presentation Must have audited Only negative assurance Restrict useE. Prescribed forms Auditor may reword or attach separate report

May 27, 2008

-

Letters to underwriter

Purpose is for the underwriter to document due diligence. = Comfort letters Not filed with SEC. Not requires, merely standard practice.Addressed to underwriter, signed by auditor.May provide negative assurance, but do not repeat the opinion of the audit report.In our opinion (include phrase except as disclosed in the registration statement, if applicable) the (identify the financial statements and financial statement schedules) audited by us and included (incorporated by reference) in the registration statement comply as to form in all material respects with the applicable accounting requirements of the Act and the related rules and regulations adopted by the SEC.

May 27, 2008

-

Review Report - AM I SAD

Public client: SAS’s Interim financial statement only Internal control evaluation: public only Client representation letter Use inquiries and analytic: less in scope than audit GAAP problem Accountant must be independent Limited assurance: “Based on our review, we are not aware of any material modifications that should be made….”Private client: SSARS Internal control evaluation: not required Use inquiries and analytic Client representation letter GAAP problem Accountant must be independent Limited assurance: “Based on our review, we are not aware of any material modifications that should be made….” Each page of the financial statements: “See accountant’s review report”We have reviewed the accompanying balance sheet of A company as of Dec 31, 2007, and the related statements of income, owner’s equity, and cash flows for the year then ended, in accordance with Statements on Standards for Accounting and Review Services issued by the American Institute of Certified Public Accountants. All information included in these financial statements is the representation of the management of A company.A review consists principally of inquiries of company personnel and analytical procedures applied to financial data. It is substantially less in scope than an audit in accordance with generally accepted auditing standards, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.Based on our review, we are not aware of any material modifications that should be made to the accompanying financial statements in order for them to be in conformity with generally accepted accounting principles.

May 27, 2008

-

Compilatoin Report - ALARD

SSARSNon-public onlyRead FS for obvious errorsIf not independent, must discloseA Accordance with SSARS issued by AICPAL Limited to presenting financial statementsA Audit not doneR Review not doneD Disclaim opinionIf disclosures are omitted, add buyer beware paragraph:“These financial statements not designed for those not informed about such matters.”We have compiled the accompanying balance sheet of X company as of Dec 31, 2007, and the related statements of income, owner’s equity, and cash flows for the year then ended, in accordance with Statements on Standards for Accounting and Review Services issued by the American Institute of Certified Public Accountants.A compilation is limited to presenting, in the form of financial statements, information that is the representation of managements. We have not audited or reviewed the accompanying financial statements and, accordingly, do not express and opinion or any other form of assurance on them.

May 27, 2008

-

Audit Report

Modified Unqualified Opinion- Opinion based, in part, on the report of another auditor- Unusual circumstances require a departure from GAAP- Uncertainties (may lead to a disclaimer)- Substantial doubt about ability to continue as a going concern (may lead to a disclaimer)- Inconsistency in application of GAAP- Certain circumstances affecting comparative statements- Required quarterly data for SEC-reporting companies- Other information in documents with audited financial statements- Emphasis of a matter; for example, related party transactions or a lawsuit- Supplementary information required by FASB or GASB- Use of special industry terms/titles- Specialized industry supplemental data included/excluded- Report reissued GAAP Problems GAAP Violation Material; qualified except for Very material; adverse Inconsistent GAAP application Justified; Modified unqualified Unjustified; qualified except for Qualified except for opinion Same intro Same scope Explanatory paragraph Opinion; except for ~ present fairly Adverse opinion Same intro Same scope Middle paragraph Opinion; because of ~ do not present fairly Modified Unqualified Opinion; Inconsistency Justified Same intro Same scope Same opinion Explanatory; As discussed in Note X to the financial statements, X Company changed its method of computing depreciation in 2007.GAAS Problems Scope limitation Uncertainty Material; Qualified except for opinion Very material; Disclaimer Going Concern Material; Modified unqualified opinion Very material; Disclaimer Lack of Independence Material; Disclaimer Very material; Disclaimer Unaudited disclaimer for a Publicly Held Company; Procedures required when associated with financial statements; read it for obvious errors. No obvious errors; write report, “unaudited” and “no opinion expressed.” Obvious error that the client refuses to correct; add a paragraph to the report. Omission of footnotes and or the statement of cash flows ; “For management use only” Not give the financial statements to anyone outside of management. The report indicates that the financial statements are for the internal use of management only. Disclaimer Uncertainty We were engaged ~ . No scope The principal assets of A ~ at cost of $XXXXX. The A’s ability to recover the cost of those investments is dependent on the success ~. Because of the significance of the matter described in the preceding paragraph, we are unable to express, and we do not express, and opinion ~. Scope limitation We ware engaged ~ . No scope Explanatory Since ~ the scope of our work was not sufficient to enable us to express, and we do not express, an opinion ~ . Going concern; modified unqualified opinion Same intro Same scope In our opinion, ~ present fairly~ the company will continue as a going concern. As discussed in Note X to the financial statements, ~ which raise substantial doubt about its ability to continue as a going concern. ~. Not independent No intro No scope We are not independent with ~ , not audited by us and, accordingly, we do not express an opinion on them.

May 26, 2008

-

Reporting on Internal Contorl

Two separate reports, or one combined report, may be issued.Sample combined report;Report of Independent Registered Public Accounting Firm{INTRO}We have audited the accompanying balance sheets of W Company as of Dec 31, 2008 and 2007, and the related statements of income, stockholder’s equity and comprehensive income, and cash flows for each of the years in the three-year period ended Dec 31, 2008. We also have audited W Company’s internal control over financial reporting as of Dec 31, 2008, based on {Identify control criteria, for ex, “criteria established in Internal Control-Integrated Framework issued by the COSO Management is responsible for these financial statements, for maintaining effective internal control over financial reporting, included in the accompanying {title of management’s report}. Our responsibility is to express an opinion on these financial statements and an opinion on the company’s internal control over financial reporting based on our audits.{SCOPE}We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (US). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was maintained in all material respects. Our audits of the financial statements included examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principals used and significant estimates made by management, and evaluating the overall financial statement presentation. Our audit of internal control over financial reporting, obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audits also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reasonable basis for our opinions.{DEFINITION}A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.{INHERENT LIMITATIONS}Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.{OPINION}In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of W Company as of Dec 31, 2008 and 2007, and the results of its operations and its cash flows for each of the years in the three-year period ended Dec 31, 2008 in conformity with accounting principles generally accepted in the United States of America. Also in our opinion, W Company maintained, in all material respects, effective internal control over financial reporting as of Dec 31, 2008, based on {Identify control criteria, for example, “criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission”}.{Sign}{City and State or Country}{Date}

May 26, 2008

-

AUDIT update

Eeligible for testing on the beginning in April, 2008・There are no longer two parts to the auditor’s opinion on internal control.・The definition of “significant deficiency” and “material weakness” have been revised. Significant deficiencies -- is a deficiency, or a combination of deficiencies, in internal control over financial reporting that is less severe than a material weakness, yet important enough to merit attention by those responsible for oversight of the company’s financial reporting. Material weakness ; is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material prevented or detected on a timely basis.・A “top-down, risk-based approach” is required.・Fraud controls are emphasized.・Guidelines on “scaling the audit” are provided.・Using the work of others is allowed.・Communication requirements with respect to deficiencies are included.・Pre-approval of non-audit internal control services is required.

May 26, 2008

-

Internal Contorl - Maijor control

Maijor Control Sales 1 Credit granted by a credit dep. 2 Sales order and invoices prenumbered and controlled AR 1 Sub.ledger reconciled to control ledger regularly 2 Ind.independent of receivable posting reviews statements bef.sending tocustomers 3 Monthly statements sent to all customsers 4 Write-offs approved by management official independent of recordkeeping responsiblity(treasurer) Cash receipts 1 Listed by individuals with no recordkeeping responsibility Cash goes to casher, remittance advice go to accounting 2 Over-the-counter cash rec.controlled(cash register tapes) 3 Cash deposited daily 4 Employees handling cash are bonded 5 Lockbox 6 Bank reconciliation prepared by ind. of cash rec. recordkeepingInventories 1 Perpetual inv.records for large dollar items 2 Prenunbered receiving reports prepared when inventory received Recieving reports accounted for 3 Adequate standard cost system to cost inventory items 4 Physical controls against theft 5 Written inventory requisitions used 6 Proper authorization of purchases and use of prenumbered purchase ordersPersonnel and payroll 1 Segregate: A: Personnel R: Timekeeping, payroll preparation C: Payheck distribution 2 Time clocks used where possible 3 Job time tickets reconciled to time clock cards 4 Time clock cards approved by superviser 5 Treasurer signs paychecks 6 Unclaimed paychekcs: special bank account 7 Personnel dep. promptly sends termination notices to the payroll dep.Financing controls 1 Debt and equity transactions are properly approved by the BOD. 2 An independent trustee handles bond transactions 3 A stock registrar and a stock transfer agent handle caital stoc transactions 4 Canceled stock certifications are defaced to prevent their reissuanceInvesting 1 Segragation authorizing purchases, sales of securities, maintaining custody or the securities, and maintaining the records of securities 2 Registration securities in the name of the company 3 Detailed records of all securities and related revenue fr.int, and div. 4 Periodical physical inspection of secirities by ind.with no responsibility for the autholization, custody, or recordkeeping for invetstmentsPP&E 1 Acuisitions are approved by the BOD 2 Properly controlled through capital budgeting techniques 3 Detailed records are available for property assets and accumulated depreciation 4 Written policies exist for capitalization vs. expensing decisions 5 Depreciation properly calculated 6 Physical contorol over assets to prevent theft 7 Periodic physical inspection of plant and equipment by who are independent of PP&E

May 26, 2008

-

29日のグアムは晴れ

ダイビングするとしたら29日。お天気はどうなのと思ってチェックしたら、晴れだ。あ・でも日焼けしたくないから晴れじゃないほがよいのかしら。。昨日今日みたいな悲しげな空よりは、晴れでいいや。のっぽさんイシキした帽子持ってきてるし。せっかくの機会なので予約してみよかな。

May 26, 2008

-

Internal Control

Internal control - Integrated framework, published by the COSO Commission defines internal control as a process - effected by an entity's borad of directors, management, and other personnel - designed to provide reasonable assurance regarding the achievement of objectives in the following categories: (a)relibility of financial reporting, (b)effectiveness and efficiency of operations, and (c)compliance with applicable laws and regulations.Components of internal control Control Environment - ICHAMBO I - Integrity and ethical values C - Commitment to competence H - Human resource policies and practices A - Assignement of authority and responsibility M - Management's philosophy and operating style B - Board of directors or audit committee participation O - Organizational structure Risk assessment. Changes in the operating environment, new personnel, new info.system, rapid growth, new lines, new products, or new activities, corporate restructuring, foreign operations, accounting pronouncements. Control Activities - PIPS P - Performance reviews I - Information processing P - Physical control S - Segragation of duties Infomation and communication Identify and record all valid transactions, discribe on a timely basis, measure the value property, record in the proper time period.. Monitoring ongoing, separate evaluations, or a combination.COSO the AICPA, the Institute of Management Accountant, the Financial Exective Institute, the Institute of Internal Auditors, and the American Accounting Association.AU314 Control environment: The auditor must obtain sufficient knowledge to understand management's and the BOD's attitude, awareness and actions concerning the control environment. Risk assessment: must obtain a sufficient knowledge to understand how management considers risks relevant to financial reporting objectives and decides about actions to address those risks.Perform tests of controls - whether controls are operating effectively. Inquiries, Inspection, Observation, and Reperformance.The Audit of Internal Control Plan the engagement-- the opinon at a point in time -- the as of date = the last day of the company's fiscal period. Evaluate management's assessment process -- must determine whether management has tested controls over all relevant assetions related to all significant accounts and disclosures.Obtain an understanding of internal control -- first audit, "walk-throughs" involves literally tracing a transaction from its origination through the company's information systems until it is reflected in the financial reports. provides the auditor with evidence to (1)confirm the understanding of the flow of transactions and the design of controls.(2)evaluate the effectiveness of the design of controls(3)confirm whether controls have been implementedTest and evaluate design effectiveness of internal controlTest and evaluate operating effectiveness of internal contorlForm an opinion on the effectiveness of internal control

May 25, 2008

-

勉強します

マイPCがすぐに調子悪くなって使えなくなったりデータ消えてしまったりするのでどこのPCでも勉強できるようにこの日記に情報キープしときます。全部ネットからの情報!!教材なくても何とかなりそう。もうこのPC今も電源コードの接触悪いみたいで電気来なかったり突然落ちたり。。バッテリー切れかと思ったけど違ってよかった。だって2万もするんだもん。

May 25, 2008

全51件 (51件中 1-50件目)